Gogolook 2022 Annual Fraud Report : Financial Loan

2023.03.01

Gogolook 2022 Annual Fraud Report : Financial Loan

Gogolook, a leading TrustTech brand, enhances global security with anti-fraud technologies and risk management services. Its financial product comparison platform Roo.Cash features personalized financial data analysis services and real-person customer services. To reduce loan fraud risks in the public, Gogolook and Criminal Investigation Bureau today (1) released “2022 Annual Fraud Report: Financial Loans” to disclose high-risk scam scenarios in financial loans.

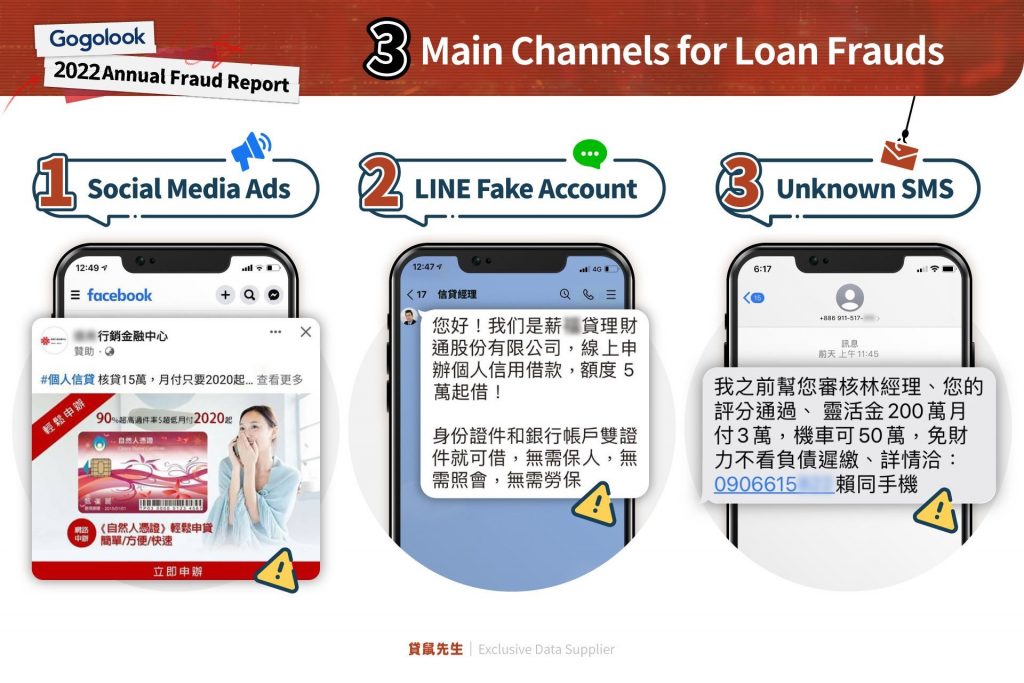

Stay alerted to common scam tactics and loan frauds on social media ads, LINE, and text messages

Rising interest rates in recent years cause global economic downturns. However, up to six million people in Taiwan face challenges to access banking services, without sufficient credit records or income certificates. Scammers and loan sharks take advantage of urgent financial needs among the unbanked communities, and distribute fake installment loans or small-amount credits via multiple channels. These fraudulent messages often lure victims into scams. According to Gogolook’s financial product comparison platform Roo.Cash, Facebook/YouTube ads, LINE accounts, and unsolicited text messages are three major channels for loan frauds to attract victims.

Roo.Cash also lists common scamming processes. Through these channels, loan frauds direct victims to scam websites and apply for loans. In submitting, reviewing, and approving the loan, they insert scam tactics, such as claiming wrong account information for security deposits and thus asking for payment to reactivate the process.In the process, they insert scam tactics, such as claiming wrong account information for security deposits. Roo.Cash urges people with credit needs to access legal products and solutions, in order to avoid scams.

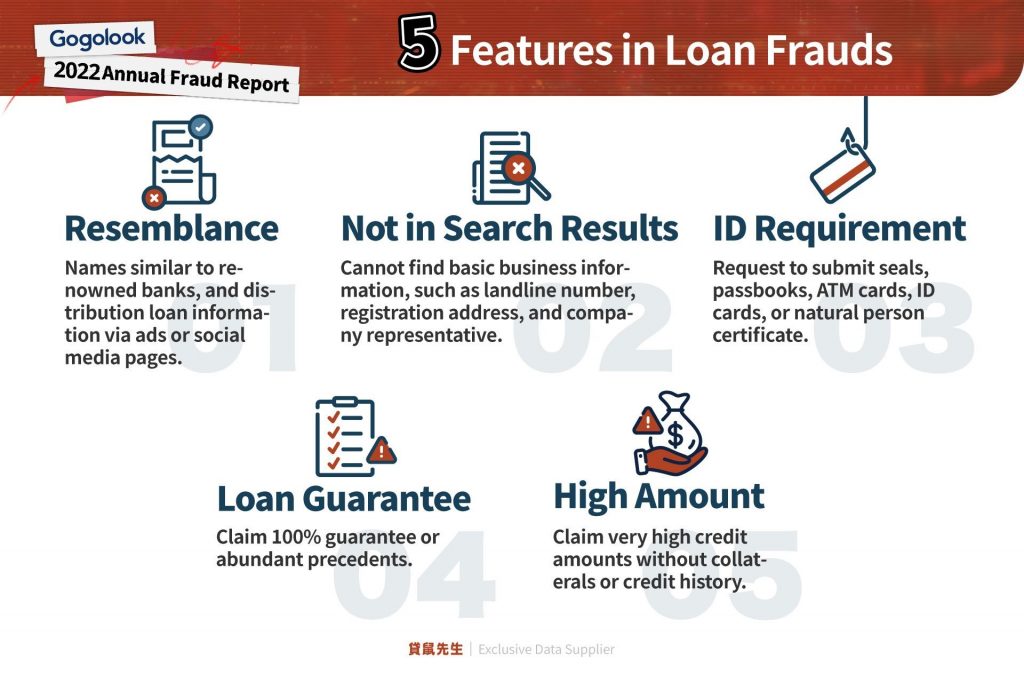

Get no money but sued? Roo.Cash discloses 5 key features for loan fraud sites

Criminal Investigation Bureau statistics show 574 loan frauds by the end of October 2022, a 77% increase compared to 2021. It indicates public anti-fraud literacy remains insufficient. To elevate public awareness, financial product comparison platform Roo.Cash analyzes common scam tactics and lists five features in loan frauds.

– Roo.Cash: Five features in loan frauds

- Resemblance: Scammers often plagiarize official websites and logos from renowned banks, and distribute information via text messages, ads, and fraudulent Facebook pages. People mistake them as parts of particular banks.

- Not in search results: It is unlikely to find any basic information behind loan frauds, such as landline phone numbers, registration addresses, or company representatives. Remember to check before act.

- Personal ID requirements: If you submit personal documents as requested for loans, such as seals, passbooks, ATM cards, ID cards, and natural personal certificates, you are likely to be criminalized, and become dummy accounts for scammers.

- Loan guarantees: Many scammers fraudulently claim loan guarantees or abundant precedents.

- High amounts: Scammers often fraudulently offer very high amount of credits without collaterals or credit records. In the process, though, they will request account reactivation fees, risk unlocking charges, processing fees, or security deposits, but never deliver credits.

- More about Cash features and services

- Download 2022 Annual Fraud Report Now

今完成送件-可望成為首間創新板改列一般板上市的新經濟軟體公司-1.jpeg)

Gogolook Announces Application for Transition to General Board Listing in Taiwan

2024.07.16 Gogolook Highlights

Gogolook Achieves Success in Japanese Market, Joins Rakuten Mobile Ecosystem

2024.07.11 Gogolook Highlights

Financial Fraud Prevention Exemplar! Bank SinoPac Partners with Gogolook for Preemptive Scam Alerts on Watch-Listed Accounts

2024.04.23 Gogolook Highlights

今完成送件-可望成為首間創新板改列一般板上市的新經濟軟體公司-.jpeg)